Make Wise Credit Card Decisions With These Tips

In many bad financial situations, a credit card can act as a lifesaver. Do you need to purchase something, but lack the cash? No problem! You can use your credit card in place of cash. Are you trying to establish a better credit score? A credit card makes it easy to do so. Read this article for more credit card tips.

Credit History

Do not close any credit card accounts without finding out how it affects your credit report. Depending on the situation, closing a credit card account might leave a negative mark on your credit history, something you should avoid at all costs. Also, maintain cards that have most of your credit history.

A retail card should only be opened if you really use that store often. When stores submit an inquiry into your credit history for a card, this gets reported on your credit report whether or not you ultimately get the card. Racking up a list of inquiries from several different retail stores can cause your credit score to drop.

Most people don’t know how to handle a credit card correctly. While there are situations in which people cannot avoid going into debt, some simply abuse their cards and rack up payments they cannot afford. It is best to pay your credit card balance off in full each month. That will let you simultaneously use credit, keep your balance low and improve your credit worthiness.

Just like you wish to avoid late fees, be sure to avoid the fee for being over the limit too. The fees you have to pay can be very costly, and it can also do some serious damage to your credit score. Be very careful to never spend above the limit on your credit card.

Credit Card

If you have just turned eighteen, you might want to think twice before applying for a credit card. Although people love to spend and have credit cards, you should truly understand how credit works before you decide to establish it. Spend a few months just being an adult before applying for your very first credit card.

Charge cards can be tied to various types of loyalty accounts. If you regularly use a credit card, it is essential that you find a loyalty program that is useful for you. This can end up providing you with a source of extra income, if it is used wisely.

Credit Card

When you buy with a credit card on the Internet, keep copies of your receipt. Keep such receipts until your bill arrives so that you can verify the accuracy of the amount charged. If an error has occurred, lodge a dispute with the seller and your credit card provider immediately. This can be an excellent method of assuring you don’t get overcharged for purchases.

Never let anyone else use a credit card that is in your name. Although you might be tempted to help out a good friend, lending out your bank cards is not a good idea. This can lead to your friendship being ruined. Or it can result in over the limit charges should your friend charge more than you authorized.

Credit card experts suggest that your credit limit should not be more than three-quarters of your monthly earnings. Also, you should never allow yourself to have a limit that exceeds your monthly salary. If you do, pay that card off and ask for a limit reduction. This is due to the fact that the interest paid will soon snowball to a point that it’s out of your control.

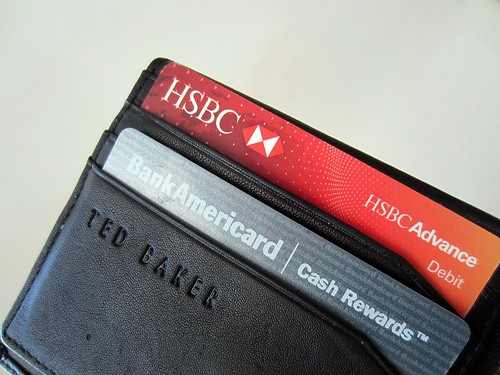

Make it a point to not take all your charge cards with you everywhere you go each day. You might have multiple cards, but you should only carry the ones you use regularly. Usually, this will include a gas card and one major credit card. Only carry the cards you will be using in your wallet. Leave the remainder of your credit cards at home.

Interest Rate

You may have a good payment history, and a good credit score, but still be paying a high interest rate on your credit card. Ask your company to lower the interest rate. In a few cases, this will happen. Any reduction in interest rate can really add up to huge savings for you in the long run.

Try using post-it notes with your credit card balances in places that you often see in your workspace. This helps you remember how high your balance is, and what types of things you are buying with credit. It can be very, very easy to get deeper and deeper into debt without being aware of it.

Charge Cards

As you can see, charge cards have plenty of uses. You can buy the things you like, and if managed properly boost up your credit in the process. Charge cards are such a great thing to have. Use the advice in this article to make sure to use your credit wisely.