Credit Card Advice That Anyone Can Try

If you’ve been looking for a great way to rebuild that poor credit rating, then a credit card might just be the perfect way to do it. In order to make the best decisions, it is crucial to know everything about bank cards. This is a listing of top credit tips to help make great credit choices.

Many people misuse their credit cards. While some people understandably go into debt sometimes, some people will abuse a card, and then they start racking up payments they’re not able to afford. The best strategy is to pay off your entire balance each month. That way you are using credit, keeping a low balance, and improving your credit score all at the same time.

Card issuers designate minimum payments so that they stand a better chance of maximizing the profits they make on interest charges. Always try to make payments larger than the stated minimum. This will help you avoid pricey interest fees in the long term.

It is common for credit cards to be linked to loyalty or affinity programs. Choose a credit card whose loyalty program offers you something valuable. If used correctly, this can supply you with a bit of extra income.

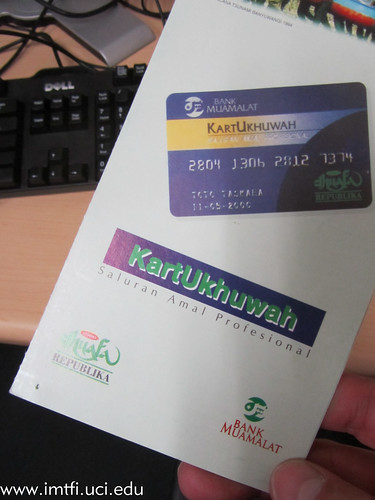

Credit Card

Those of you looking to get a new credit card should limit their search to cards that have low interest rates and do not have an annual fee. It is wasteful to get a credit card that levies an annual fee when so many other cards are available that are free.

To keep more money in your wallet, don’t be afraid to ask your credit card company for a better interest rate. If you have a significant history with a credit card company, and have paid your payments in a timely manner, they may be willing to offer you a lower rate. Simply call up your creditor and ask for a better rate.

Everyone has had a similar experience. You received one of those annoying credit card offers in the mail. There may be times when you want to get one, but not all the time. When you toss this kind of mail, shred it or tear it up. Do not just toss it because many of these solicitations have your personal information on them.

Don’t pay off your card immediately after making a charge. Instead, hold off until your statement arrives so you can pay off the full amount. This will better benefit your credit score.

Avoid closing accounts. It may be the initial reaction when you want to preserve the score of your credit, but it will actually have the opposite effect by making your score worse. The reason is because the amount of available credit you have is lowered and that will be balanced against what you owe.

Credit Score

Some people avoid getting any charge cards, to afford the appearance of having no debt at all, and this can be a mistake. If you want to build on your credit score, then one credit card is necessary. Use the card, then pay the balance off every month. It isn’t possible to have a good credit score if you never use credit.

Keep track of the amounts you put on your card and look at it often. Doing so helps to visualize the total amount you have spent. It can be very, very easy to get deeper and deeper into debt without being aware of it.

Monitor your credit score in order to determine how you’re doing with your accounts. Taking this step also enables you to make sure that others are managing your accounts well. Try to note any cases of reporting errors. If you find one, contact your credit card issuer and the three credit bureaus immediately.

Credit Card

Pay the bill for your credit card expenses in full every month. Each month that you don’t pay off your card, you will end up with a finance charge. These added costs can make it very difficult to pay down even a modest credit card balance if you stick to making the minimum payment every month.

Don’t pay money before you receive a credit card, unless you are seeking a secured card. Legitimate credit card companies do not request fees upfront. Additionally, never pay anyone money in exchange for them helping you get a new credit card. If you possess good credit, you should have the ability to get one by yourself.

As said earlier, charge cards can be good and they can be bad. They can help to build a good credit score, but they can also get you in trouble. Understanding individual cards is critical, as this can assist people in making educated choices. Educate yourself on the basics of responsible credit card use so that you always make smart decisions.