Credit Card Tips You Should Not Ignore

Bank cards give people the ability to make purchases without making instant payment. However, you need to know the basics of wise credit card usage so that you do not end up buried in debt. Read this article for great credit card advice.

Inspect the fine print carefully. Make sure you understand what you are getting involved in, even if it is a pre-approved card or a company offering help with getting a card. Be aware of how much interest you’ll pay and how long you have for paying it. Furthermore, make sure you are aware of potential fees or billing grace periods.

Many credit card offers include substantial bonuses when you open a new account. Pay attention to the fine print on the card; in order to get the bonus, there are often certain terms you have to meet. For example, you may need to spend a specific amount within a certain period of time in order to qualify for the bonus. Be sure that you’ll be able to meet the requirements before you let the bonus offer tempt you.

Communicate with your creditor if you ever run into financial hardships. Oftentimes, the credit card company might work with you to set up a new agreement to help you make a payment under new terms. Doing so means they may not report your late payments.

A cosigner can help you obtain a credit card if you have yet to establish credit. A parent or other relative may be willing to be a co-signer. They are required to state their willingness to assume responsibility for outstanding balances if you fail to pay. This is one of the best ways to land your first card and start building a good credit score.

Think wisely about how you use your bank cards. Limit spending and only buy things on your credit card that are affordable to you. When you use the card, you have to know when and how you are going to pay the debt down before you swipe, so that you do not carry a balance. If you carry a balance, your debt will grow and the total balance will be harder to pay off.

Credit Card

Never make purchases with your credit card, that you cannot afford. A credit card isn’t the magical solution to getting the flat screen TV or new computer that you have always wanted. You will end up paying a lot of interest and your monthly payments might be more than you can afford. Make decisions only after thinking them over for a couple of days. If you do decide to make the purchase, see if the store offers financing that is usually lower interest than your credit card.

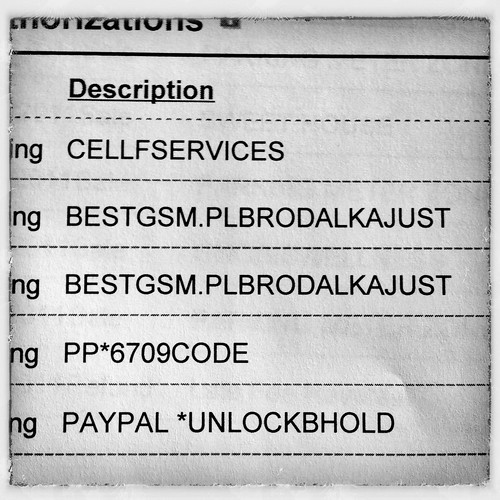

When you charge something online, print a copy of the receipt. Keep that receipt until the credit card bill comes in the mail and verify that all figures match up. If any charges are incorrect, you should immediately file a dispute. Doing so helps to prevent overcharges on purchases.

Do not simply believe that the interest rate you are offered is concrete and should stay that way. Card companies use different interest rates for competition purposes. If you are unhappy with your current interest rate, simply call your credit card company and ask for a lower rate.

Credit Card

Never give credit card numbers out, online, or over the phone without trusting or knowing the comapny asking for it. When someone calls you, be very wary of giving out your credit card number. You can’t be sure they are who they say they are. There are many dishonest people in the world who want your information. Be thorough and protect your card number.

When consumers use bank cards with good financial wisdom and common sense, they can be extremely helpful. Keeping yourself as debt free as possible and upholding a solid credit score is possible when you apply the tips from this article. When you accomplish this, your cards stay available to make purchases when you need to make them.