Credit Card Usage And Suggestions From People Like You

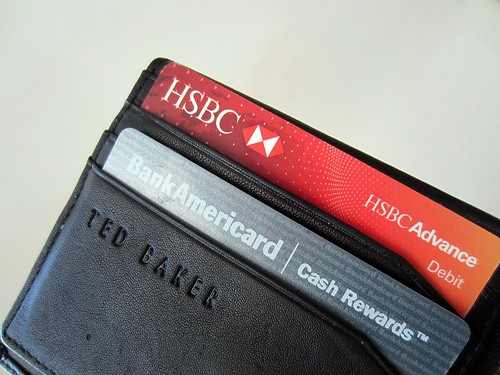

One good credit card may be a great help in cases of emergency or immediate financial needs. Need to buy something but your wallet is empty of cash? Not a problem! Having a credit card can get you out of an immediate jam. Are you attempting to build a good credit score? You can do it with a credit card! Continue perusing this piece to gain practical information about bank cards.

Keep up with your credit card purchases, so you do not overspend. Getting carried away with credit card spending is easy, so keep careful track each time you use it.

Always pay credit payments before they are due. This increases your credit score. If you don’t do this, you could incur costly fees and harm your credit score. Using automatic payment features for your credit card payments will help save you both money and time.

Credit Card

Make sure you know the current interest rate of the credit card you are applying for. It is extremely important before you sign on to getting that credit card that you must know the interest rate. If you are unaware of the number, you might pay a great deal more than you anticipated. It’s always a good idea to pay off your credit card in full every month, but this may be impossible if you are paying more than you expected.

If you run into financial difficulty, let your credit card company know. You may be able to adjust your payment plan so that you won’t miss a credit card payment. Most companies will work with you if you contact them in advance. This may stop them from turning in a late payment to the major reporting agencies.

Many times, credit cards are associated with loyalty programs. If you use credit cards on a regular basis, it is wise to find one with a loyalty or rewards program that you find personally useful. These programs can provide a source of income, when they are used wisely.

Credit Card

Take care to read all emails and letters that come from your credit card company when you receive them. Credit card providers can make changes to their fees and interest rates provided that they give you a written notice of their changes. You have the right to cancel a credit card if you disagree with any changes.

Those of you who want a new card should keep their searches to those that have no annual fees and interest rates that are low. There are many options that don’t have annual fees, so it is silly to choose a card that does.

If your mailbox does not lock, do not order charge cards that come in the mail. Credit card thieves have stated that they steal cards out of unlocked mailboxes.

Family Member

Never lend your credit card to a family member or friend. Even if it’s a good friend that needs something badly, it’s not smart just to lend a card out. There are other ways to help a friend or family member in need other than allowing them to borrow your card.

If you have poor credit, you may want to apply for a credit card that is secured. These cards require you to have a balance to use as collateral. With a secured card, you are borrowing against your money and then paying interest to use it. This is not the ideal situation, but it can help some individuals to rebuild their credit score. When you are going to apply for one of these secured charge cards, make certain the company you choose is reputable. They may later offer an unsecured card to you, and that will boost your credit score even more.

One effective suggestion for credit card users is to not make a payment on your credit card right after you charge an item. Instead, pay off the balance in full when your card statement comes in. Doing this will improve both your credit score and payment history.

Never give anyone credit card numbers on the Internet or on the phone unless you know and trust the company. When someone calls you, be very wary of giving out your credit card number. You can’t be sure they are who they say they are. There are a lot of shady people out there and they often try to get credit information over the phone. Protect yourself by remaining diligent.

Now you understand just how credit works. They can be used to buy groceries, for the sole purpose of creating a strong credit profile, and for many other reasons. Make use of the tips above and learn to use your bank cards wisely.