Helpful Credit Card Information You Should Keep Close By

Cash is always good, but credit cards mark the future of finances. As banks start to charge more for just about every kind of credit service, more and more people are using their credit for all types of transactions. Check out the suggestions provided below to pick up some great ideas for using bank cards more effectively.

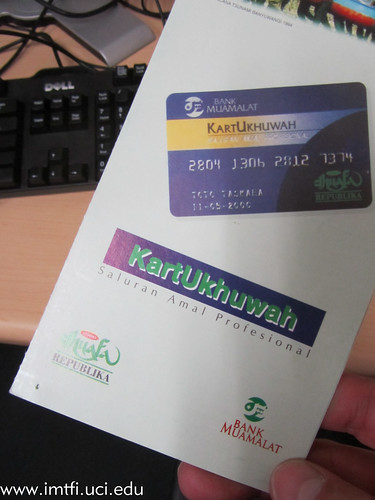

Credit Card

Immediately report any fraudulent charges on a credit card. Immediate action you take gives your credit card company an upper hand in catching the thief. That is also the smartest way to ensure that you aren’t responsible for those charges. Any charges that you did not make need to be reported to your credit company with a phone call or a high priority email.

Pay close attention to your credit balance. You should also remain aware of your credit limit. Going over your credit limit will raise your fees and your overall debt. It will take forever to pay down your balance if you continue to go over your card’s limit.

The payment of your bank cards bills should be paid on time each month. All card balances have due dates. If you ignore them, you have the risk of getting charged large fees. Also, many creditors will increase your interest rates costing you even more money in the future.

If your mailbox is not secure, do not request charge cards through the mail. Many people that steal credit cards have admitted that they have stolen cards that were delivered and placed in mailboxes that did not have a lock on them.

Never lend your credit card to a family member or friend. Although you might be tempted to help out a good friend, lending out your credit cards is not a good idea. That can lead to charges for over-limit spending, should your friend charge more than you’ve authorized.

Credit Card Information

Be careful when purchasing things online. Prior to entering credit card information within the Internet, be sure you’re using a secure site. When a website is secure, your card’s information is as well. Also, ignore emails that ask for credit card information, these are attempt to get your information.

Read the fine print to determine what conditions may affect your interest rate as they can change. The credit card business is a competition. Therefore, all card companies have varying interest rates they can utilize. If you think your rate is too high, you can often call the issuing bank and request that they change it.

Interest Rates

Check with your credit card company about their willingness to reduce your interest rates. Sometimes, especially if you have a long and positive history as a customer, companies are willing to reduce their interest rates. It can save you a lot and it won’t cost you to simply ask.

Research all of the charges that a credit card company may include with an offer. Look beyond interest rates. Sometimes there are charges like cash advance rates, service charges and application fees that would make the card not worth it.

Keep a note posted in a visible spot in your house, indicating your credit card purchases. Doing so can remind you just how much you have spent and on what. Failing to monitor spending often leads to over extending ourselves and before long, that can mean serious financial trouble!

Fully Understand

If you are thinking about applying for a credit card which is offering cheap balance transfers or a great introductory interest rate, make sure that you read all of the small print in the terms and conditions. It is crucial that you fully understand what is going to happen upon the expiration of the introductory period. Often, these great sounding offers cover up the fact that the interest rates will be quite high once this time is over. Fully understand what the card entails when you sign up for it.

Because many debit cards have been adding fees and strict regulations, bank cards are becoming a more popular form of payment. You can also use the benefits that bank cards offer thanks to its increased use. Use the information presented in the tips above to help you to get the most from your charge cards.