Helping You Better Understand Personal Finance With These Simple To Follow Tips

Money management has an affect on almost every part of your life. You must take control of your finances to be successful in life. The tips in this article will help you easily manage your money.

Keep in touch with world events so that you are mindful of global financial developments. A lot of people tend to ignore important world news which can impact their own financial situation at home. If you are aware about what is happening in the world, you can improve your strategies and make more educated predications about the stock market.

This is a time of considerable economic uncertainty, so it makes sense to save your money in several different places. Put some money into a standard savings account, leave some in your checking account, invest some money in stocks or gold, and leave some in a high-interest account. Utilize all of these to help keep your financial position stable.

Do not pay the full price for anything. Don’t feel like you need to be loyal to specific brands, and concentrate on buying only when you have a coupon handy. If your family usually uses Tide, for instance, but you have a good coupon for Gain, choose the less expensive option and pocket the savings.

Form strong plans and always stick with them to ensure your finances fall into their needed place. An established financial plan may motivate you to minimize your spending and to work harder.

Big lifetime purchases include buying a car and a home. Interest rates and payments on these two items will most likely be the bigger part of your monthly budget. Paying these expenses quickly can reduce the interest payments that you will incur.

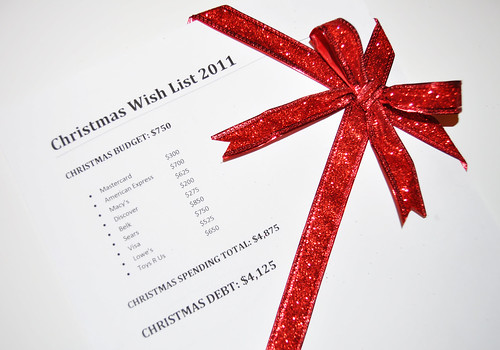

If you’re having trouble paying the minimum on your credit card, stop using it. Try to lower your expenses as best as you can and look for other payment methods, so that you don’t max your credit cards out. Don’t use your card until your monthly balance has been paid off.

To gain financial stability, you need to have a savings account that you contribute to on a regular basis. Doing so will let you get the loan you need, even in hard situations. If your savings are great enough, a loan may not be required at all. Even if you can’t afford to put too much money in there every month, save as much as you can.

Buying a car is a very serious decision. Comparison shopping with all of the different retailers available to you is the best way to make sure you get a good price on a car. If you do not find any good prices, you can try the Internet.

Credit Card

If you want to have a credit card but are younger than 21, know that rules have changed recently. In past years, any college student could get a credit card. Today, you must have verifiable income or a co-signer to qualify. Read the fine print about the card before signing up for it.

If someone would like to make a purchase but the cost is too high to buy immediately, it might be possible to involve his or her family. If it is something that everyone could use and benefit from such as a third television one can convince their whole family to pool their money to purchase the item.

You’ll find that your FICO score is heavily affected by the amount of money you are carrying on your credit cards. The higher your balances are, the worse they they are for you. When you take care of these balances and pay them down, your score will start climbing. Make sure to keep your card balance at least 20 percent below its maximum limit.

Allow your profits to run in Forex. Use the tactic in moderation so that greed does not interfere. When a trade has been profitable for you, know when to say enough and withdraw your funds.

Although it takes some foresight and a willingness to sacrifice convenience, you’ll find it does save you money to make use of only the ATMs operated by your bank or other financial institution. Financial institutions often levy hefty per-transaction and monthly fees for using the ATM of other banks, and these fees can add up very quickly.

Try purchasing non-brand name products in place of expensive well known brands. Major brands spend a lot of money marketing their products, which raises their costs. Think about choosing the lower priced, generic brand instead. There’s seldom any difference when it comes to taste, quality or performance.

Money management influences all that you do. Be sure that you maximize these good things by incorporating these guidelines into your personal finances.