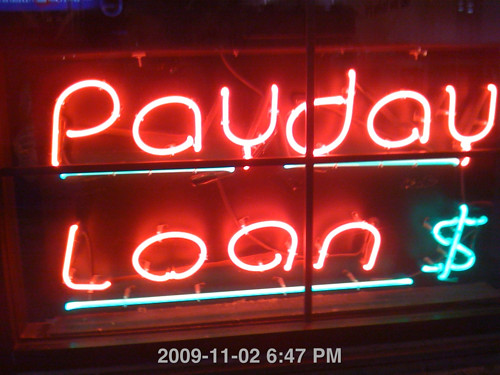

The Most Important Aspects Of Payday Cash Advances

A payday loan could be the answer to your problems if your are in a time crunch and need money quickly. Payday cash advances can end up being a double-edged sword. The information in this article will educate you about payday advances and provide you with payday loan tips and advice.

If you’re thinking about biting the bullet and using cash advances, you need to realize that the amount of interest you’ll be charged is extremely high. Rates routinely exceed 200 percent. The lenders that do this usually use every loophole they can to get away with it.

Ask about potential fees. You have no way of knowing what you’re being charged if you do not ask. Make sure your questions are clear and direct. If you don’t check, you may find you owe more than you meant to. Avoid this situation by reading the entire agreement carefully and asking questions as needed.

Know the exact date when your payday loan will come due. If you miss the payback date, you might be subjected to very high fees. Keeping this in mind, make sure your loan is paid in full on or before the due date.

More and more companies are popping up and offering payday advances. In case you are not sure exactly what a payday loan is, it is a small loan which doesn’t require a credit check. This kind of loan is almost always short-termed. Although these loans are short-term, look for really high interest rates. However, they can really help people who are in a true financial bind.

A good tip for anyone trying to apply for a payday loan would be to locate a lender who will work with you should any unforeseen financial trouble arise. Some lenders are willing to extend your loans if you cannot pay them on the due date.

Know about payday advances fees before you get one. It could cost 30 dollars in fees or more to borrow 200 dollars. The interest fee comes out close to 400% yearly. The fees are even more if you delay payment.

Before taking out a payday loan, research the lending company and see if they have a good history. You may find many solid payday lenders; however, they may not necessarily be trustworthy. If there are filed complaints, find out how the company responded.

When your loan comes due, you better have the money in your account to pay it off! If you lack a reliable income getting a payday loan may be a mistake. If you don’t get a deposit and something unexpected happens, you could owe the loan company more.

If you suddenly are offered more money than you need, the sensible choice is to turn them down. Lending companies offer more because it means they get more back in fees and interest. Look out for your own interests and only take out what you must have to get by.

Be sure to understand the fees and costs involved in taking out a payday loan. Remember that payday advances always charge high fees. Failure to pay your loan on time will result in additional fees and penalties.

Figure out what the APR is before you take out a loan. Lots of people avoid looking at the APR; however, it’s the one thing that you should look at above everything else because it informs you of the fees and interest you’ll have to pay.

Payday Loan

Prior to applying for a payday loan, do some research. Although, you might feel there is no time to spare because the money is needed right away! Cash advance loans come fast, so once you decide, you will get the money immediately. Sometimes, you can get instant or same-day cash. Search online to find the cheapest rates, to discover lender complaints on the website of the BBB, and to determine if you can find other methods of obtaining the money you need without having to pay high payday loan fees.

Be prepared to supply your bank account number and understand that any company you deal with will be able to withdraw funds from your account if you miss a payment. You must be aware of this as well as the dangers involved with it. A seemingly simple payday loan can turn into an expensive and complex financial nightmare.

Payday Cash Advances

Although payday cash advances can help you when you need money right away, you must also be aware that if you aren’t careful they can lead to much worse financial problems for you. Utilize the knowledge you’ve just learned in order to make the best decisions on payday cash advances.