How Many Bank Cards Should You Have? Here Are Some Great Tips!

Anyone can build credit, while managing their finances, with a credit card. It is necessary to gain an understanding of charge cards, however, in order to use them wisely. Below, you will find some great tips on using charge cards and using them wisely.

Speak with the credit card company right after you see a charge on your statement that you did not make. This will give the company a greater possibility of catching the perpetrator. Also, by notifying the credit card company immediately, you can ensure that you aren’t in any way responsible for the charges. Fraudulent charges could be reported through a phone call or through email to your card provider.

Only inquire in regards to opening retail cards if you seriously shop at that store regularly. When you apply for store charge card, an inquiry is noted on your credit bureau report whether you are approved or not. Too many inquiries can make your credit score go down.

Always make sure there is not a yearly fee attached to any credit card that offers rewards or perks. Some exclusive charge cards require you to pay between $100 and $1,000 per year to keep the card, depending on exactly how exclusive the card is. If you have no need for such an exclusive card, you may wish to avoid the fees associated with them.

Getting a brand new credit card as soon as you are legally able to isn’t necessarily the best idea. Although many people do this, you should take some time to become familiar with the credit industry before getting involved. Experience being an adult prior to getting yourself into any kind of debt.

If you do not own a locking mailbox, never order credit cards through the mail. Many bank cards get stolen from mailboxes that do not have a locked door on them.

Credit Report

A smart tip for all people with charge cards is to request copies credit report copies. It’s free, and you want to be certain that all the information is correct. Compare your statements to the debt on your credit report and make sure they match up.

Ask your credit card provider if they are willing to reduce the interest rates associated to your credit card. There may be some companies that could reduce the interest rates they charge if they know that they have a good relationship with their customers. It doesn’t cost you a penny to ask, but it can save you a lot of money.

If you owe more money on your card that you could pay back, you are risking damaging your credit score. If your credit rating is damaged, it can be hard to get insurance, a car, or an apartment. Sometimes it affects your ability to get a job.

Negotiate with your credit card company about your interest rate. It is always possible to negotiate with a card issuer to secure a better rate. If you have a history of paying off your balances on time, the company will be more likely to grant your request for a lower APR.

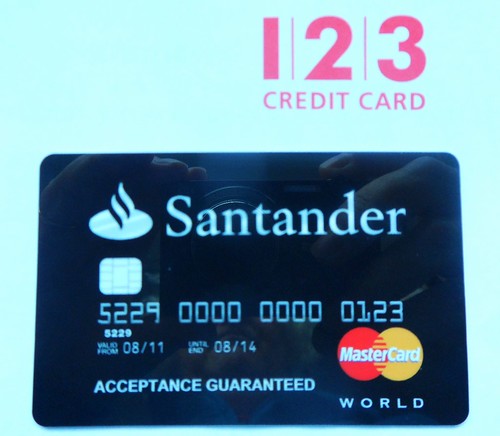

Credit Card

Keep a close eye on transactions made with your credit card. Ideally, you should sign up for text alerts if they are offered by your credit card company. When you monitor your credit, if anything appears out of the ordinary, you can fix it immediately. Contact your bank if you learn of activity you didn’t authorize. You may also need to contact police.

If your credit card is lost, and presumably stolen, report the missing card to your credit card company immediately. You may be held responsible for any charges incurred on your stolen credit card prior to you reporting it missing. Any charges accrued after you have reported the card as missing cannot be on-charged to you by the card provider.

Don’t pay money before you receive a credit card, unless you are seeking a secured card. No credit card company that is legit will ask for a fee upfront. Additionally, you shouldn’t pay anyone to get you a card. So long as your credit is decent, you should be able to find your own credit card.

It is not always the best practice to use your credit card because of the airline points or perks that it offers. Charging everything on one card to get free plane tickets might prove successful. However, you may get interest and fees equal to several flights.

Following the tips above, an individual can benefit while trying to build credit and manage their finances. However, take the time to truly understand the credit cards and what they can do to help you, so you are able to make informed decisions. Educate yourself on the basics of responsible credit card use so that you always make smart decisions.