You Can Increase The Cash In Your Wallet With These Ideas

In order to survive in this world, it is important to learn all there is to know about money. Our grandparents were taught about money the hard way, and this taught them they needed to save, be thankful for things they had, and to spend less than what they made. Many people in modern times do not end up learning about money until they are older, which makes it harder to adjust and to budget. You can figure out how to manage your money properly and make the most of it with these tips.

The most important factor in successful personal finance is effective money management. Protect your profits and invest your capital. You can use your profits to build your foundation but make sure you manage your investments smartly. You should always have a standard set for what you plan to keep as profit, and what you will reallocate into capital.

Stay up-to-date with financial news so you know when something happens on the market. While you might be inclined to only pay attention to U.S news, ignoring the international news is a one of the biggest mistakes American currency investors make. If you are aware of what is happening in the rest of the world, you can adjust your strategy so that you can make better predictions about the market.

When you are trying to save some money abroad, eat at local restaurants. Restaurants in your hotel, as well as in areas frequented by tourists tend be be significantly overpriced. Look into where the locals go out to eat and dine there. This is a great way to find authentic food at a budget-friendly price.

In these times, spreading your money into different areas is a great idea. A savings account, check account, high interest account and stocks will help you make the most of your cash. Utilize a variety of these vehicles for keeping your money safe and diversified.

If you find that your credit card balance is creeping up and you are having trouble keeping up with the payments, it’s a good idea to stop making charges. Cut your extras spending off, and see if there is some other way to make payments on the card so that it does not get maxed out. Before using the card again, pay off the balance in full.

Making regular deposits to a savings account is important for your financial stability. With money in savings, you may be able to avoid getting loans, and will also be in a position to handle unusual expenses. You may not be able to put much in each month, but it is still important to save regularly.

Cfl Bulbs

Older incandescent bulbs should be replaced with newer CFL bulbs, which are much more energy-efficient. This kind of bulb will help you reduce your electric bills significantly. CFL bulbs should last much longer while using less energy. This will help you save money on replacement bulbs.

Keep student loans to a minimum unless you are confident that you will be able to pay them back comfortably. You could wind up in serious debt if you pick a costly private school when you don’t even know what career path you want to take.

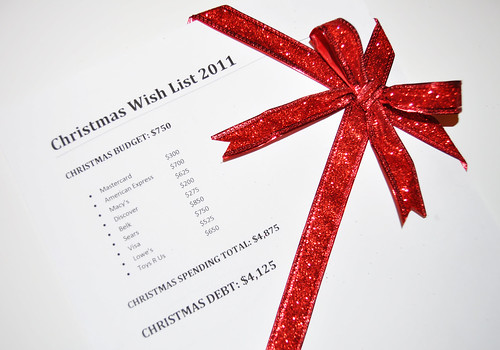

You could give homemade presents for Christmas to save money. You will spend less and you will save a lot of money during the holidays. Think of creative ways to cut costs, and show your friends and family your artistic side.

Dollar Bills

Anyone finding that they often have single dollar bills in their pockets can use those bills in an interesting way that might be a great help to their finances. Using the dollar bills and buying lottery tickets with them is a fun way to possibly have much more money than was spent on the tickets.

It’s important for everyone to understand personal finance. Tracking your hard-earned dollars and proactively managing your spending and saving can make your financial status something to be proud of. Following the tips presented in this article will bring you closer to reaching your financial goals.